FlagrightIt is aAI-native anti-money launderingAML)andCompliance risk management platformIt provides fintech companies and banks with end-to-end automated compliance and risk control capabilities. Its core highlights include...Real-time transaction monitoring, AI-powered forensics, automated customer risk assessment, suspicious activity detection, and automated compliance report generation.Wait, the whole processSaaSAPI delivery supports rapid integration and continuous optimization. Flagright adopts a flexible pay-as-you-go model, suitable for various scenarios including fintech startups, banks, payment platforms, and cryptocurrencies. Compared to traditional compliance platforms, it boasts extremely fast integration speed and highly automated AI, helping institutions significantly reduce labor costs and improve compliance response speed, making it a key driver of intelligent compliance transformation in the current financial industry.

In today's highly digitalized fintech and banking landscape, financial crimes are becoming increasingly complex and varied, posing unprecedented challenges to compliance and risk control.Flagright(Official websiteIt was born in this context, relying on itsAI-native anti-money laundering (AML) and compliance risk management platformFlagright provides intelligent and efficient regulatory compliance and anti-fraud tools to fintech companies and banks worldwide, aiming to revolutionize the way the financial industry combats illicit activities. Flagright belongs to [the relevant authority/organization].AI Legal AssistantThis type of product demonstrates exceptional innovation within the industry.

Flagright's main functions

Visit the official website for feature details.

- Real-time transaction monitoring—Automatically screen all transactions for anomalies and model behavioral patterns;

- AI Forensics Intelligent Survey—Use natural language descriptions to quickly generate survey reports and improve the productivity of the 90% team;

- Customer risk score—Build customer profiles from multiple dimensions and automatically assess risks;

- Automatic detection of suspicious activity—Reducing false alarm rates using AI and machine learning;

- Automatic generation of compliance reports—One-click output of SAR, CTR and other messages required for monitoring;

- KYC & AML Screening—The API supports real-time identity and background checks;

- End-to-end API integration—Integration and launch can be completed in as little as one week, with open APIs for integration with third-party systems;

- Continuous policy governance and change trackingAI assists in regulatory change processes;

- Quality Assurance and Compliance Automated Inspection—The QA module enables batch sampling and compliance review.

| Functional modules | Featured Description | AI intelligent support | Compared with traditional methods |

|---|---|---|---|

| Transaction monitoring | Real-time, full volume, high frequency, multi-channel | √ | Second-level response / slow human reaction |

| Customer risk assessment | Automatic classification based on comprehensive behavior, region, history, etc. | √ | Multi-person team/Difficult to quantify |

| AI Forensics | NLP descriptions and report generation, automated dispute investigation | √ | Manual search / Documents are easily missed |

| Compliance Reports | One-click SAR/CTR output, personalized customization | √ | Complex export/pressing manual |

| API Integration | Standardized integration of SaaS and APIs, compatible with mainstream financial systems. | √ | Long customization cycle |

| Regulatory tracking | Automatic assessment and notification of regulatory changes | √ | Follow up manually |

| quality assurance | Automatic data sampling, QA files, statistical analysis | √ | Manual statistics/inefficiency |

Flagright AI Forensics Innovation Highlights:It supports team useNatural language directly initiates compliance investigationsIt automatically analyzes and generates visual reports, reducing false alarms to 7% and improving efficiency by 5 times.View the official demo。

Flagright's Pricing & Solutions

- Pay-per-useFlexible pricing based on usage such as transactions and API calls, with no fixed monthly fee.

- Free trialThis is a demonstration of a Proof-of-Concept (POC) test; no card binding or registration is required.

- Customized Enterprise SolutionsSupports banks and multinational institutions, and integrates multiple modules.

| plan | Applicable customers | Price characteristics | Includes services |

|---|---|---|---|

| Introductory Plan | Small Fintech Companies | Pay-as-you-go | API integration, core compliance module |

| Growth Plan | Medium and large institutions | tiered pricing based on transaction volume | Automation of surveys and reports, etc. |

| Corporate customization | Banks, multinational corporations | Customized negotiation | Full-stack, dedicated technical support |

How to use Flagright

- Register an accountCertified company information.

- API IntegrationData is integrated according to the document.

- Configuration rules: Can be customized or with the assistance of an advisor.

- Real-time monitoringData automatically drives risk control and compliance.

- Compliance Investigations & ReportsExport the required reports with one click.

- Strategy optimization and regulatory synchronizationPlatform intelligent reminders and upgrade logic.

| step | Key Operations | Time required | Automation support |

|---|---|---|---|

| register | Certification body information | 5-30 minutes | √ |

| API Integration | Interface technology | 1-7 days | √ |

| Configuration rules | Strategic Compliance Template Selection | 0.5-2 days | √ |

| Daily operation | Risk control screening | real time | √ |

| Report Export | Compliance/SAR and other reports | Seconds | √ |

Flagright's target audience

- Fintech companies (such as digital banks, cross-border payments, etc.)

- Banks, new banks

- Cryptocurrency Platform

- Securities firms, insurance companies, consumer finance companies, law firms, etc.

| Industry type | Application scenarios | effect |

|---|---|---|

| Digital Bank | Account opening, fund transfer | Fast KYC verification, real-time monitoring |

| Payment companies | Cross-border, micro-payment | Fraud detection and compliance reporting |

| Encryption Platform | Deposit and withdraw | Abnormal link analysis |

| Loans/Consumer Finance | Lending and repayment | Automatic risk classification and blacklist verification |

Flagright Platform Advantages

- Ultra-fast integration—Standard API launched within a week.

- AI-driven automation— False alarms and human labor hours decreased by 90%+.

- Full-stack compliance capabilities—One-stop data flow, rule control, and reporting.

- Global multi-jurisdictional compatibility—Real-time policy synchronization.

| Dimension | Flagright | Traditional system |

|---|---|---|

| Integration cycle | 1-7 days | Several months+ |

| level of automation | 90%+ Automatic | Manual/Repeat |

| AI intelligence | NLP prediction, intelligent recognition | Static rules |

| Regulatory response | Automatic push | Delayed update |

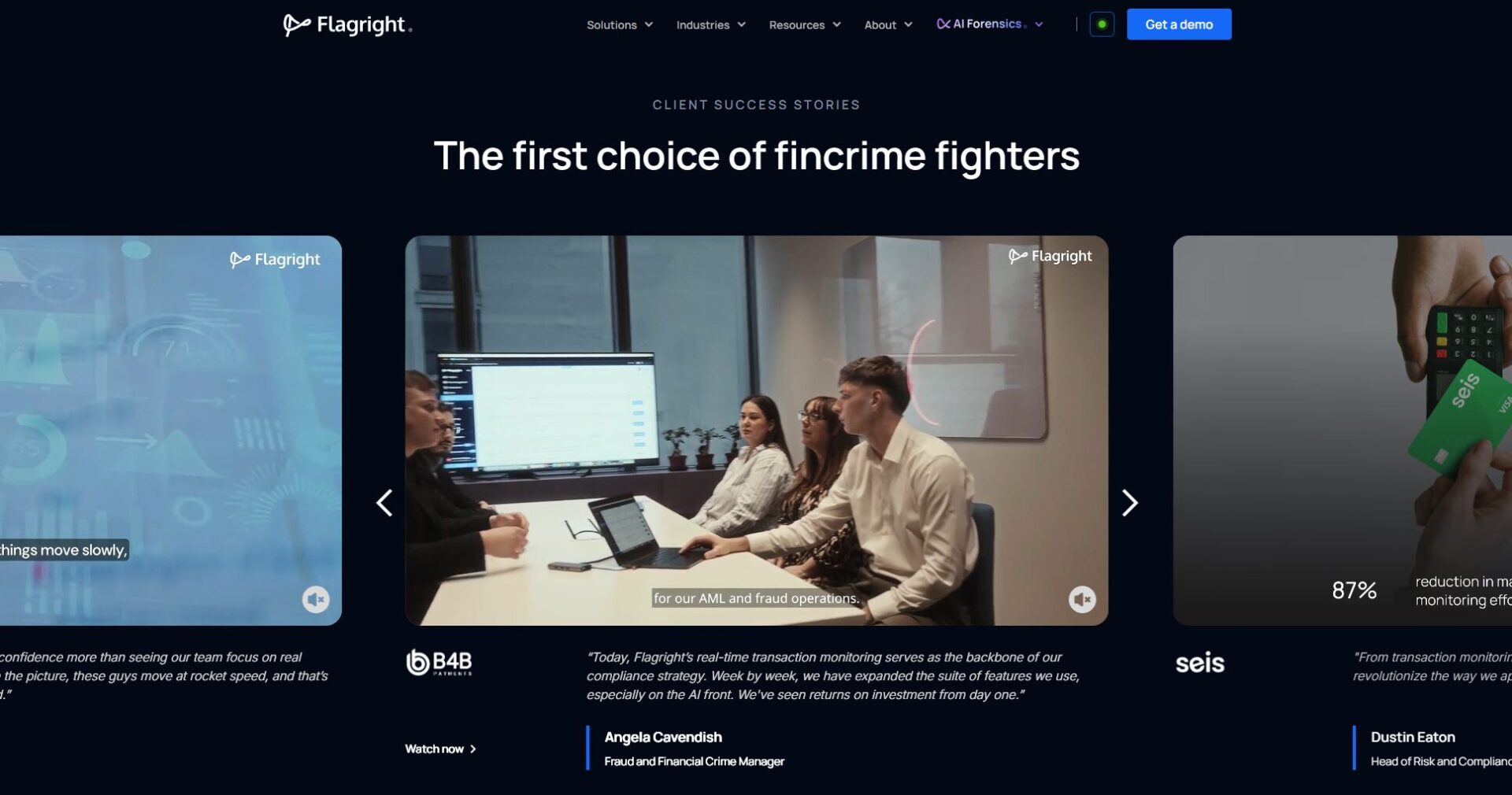

Flagright Typical User Cases

- Digital banking: KYC automation reduced false alarm rate by 901 TP3T and team man-hours by 801 TP3T.

- International payment company: Launched in 7 days, with timely compliance reporting in multiple locations.

- Cryptocurrency platform: AI Forensics enables rapid tracing and second-level export of compliance reports.

Frequently Asked Questions

What is Flagright?

Flagright is aAI-driven anti-money laundering compliance and risk management platformThis supports financial institutions in achieving efficient compliance and risk management.

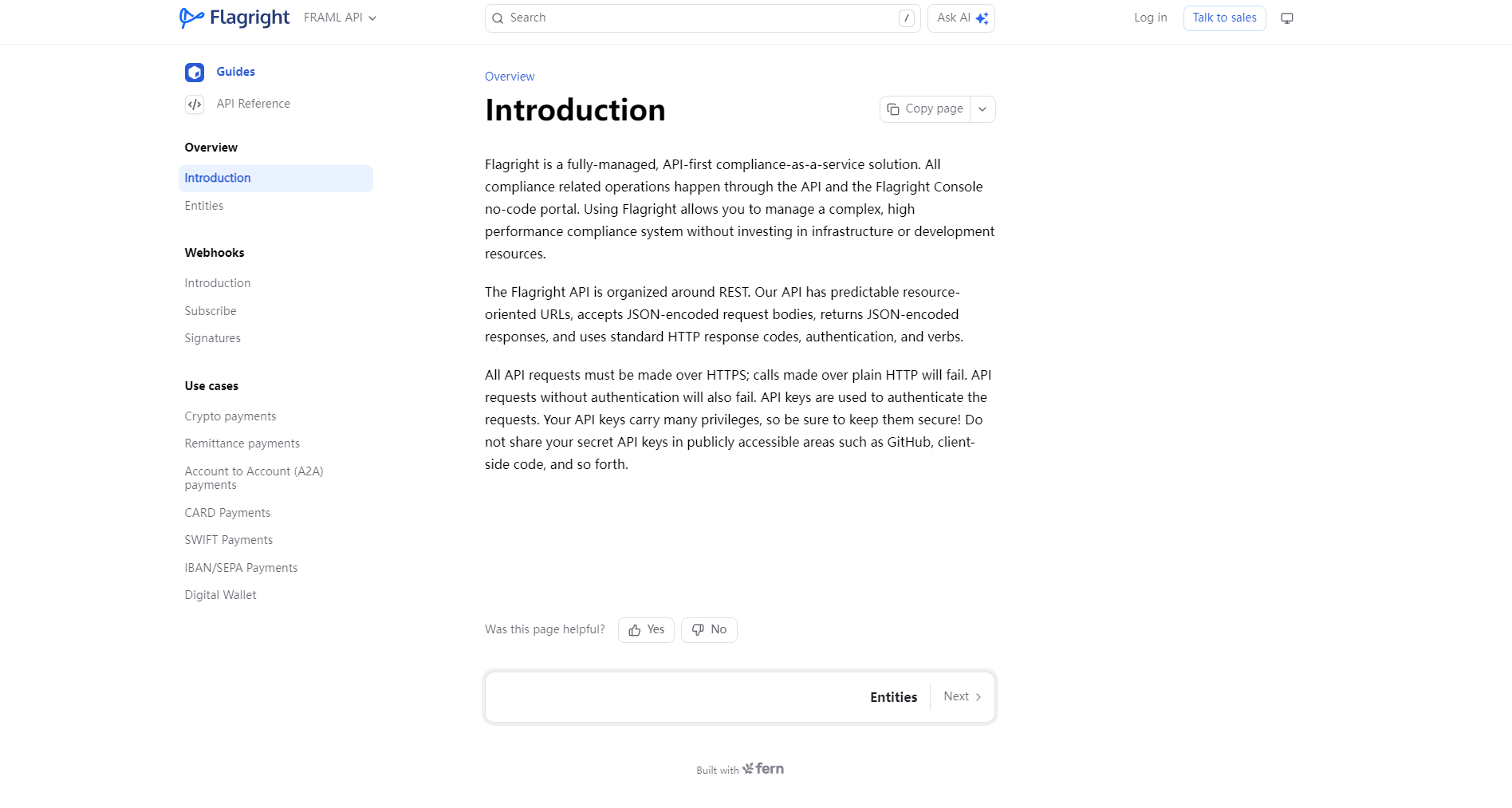

How do I integrate Flagright?

It supports SaaS web interface and RESTful API, and is compatible with mainstream financial business systems.

Which languages and jurisdictions are supported?

It supports multiple languages including Chinese and English, and can customize local regulations and rules according to business needs, adapting to mainstream global regulations.

In the wave of fintech,Flagright's AI-driven, full-stack automated complianceEnable institutions to efficiently address challenges related to money laundering, fraud, and risk control, leading the future of intelligent and compliant finance.

data statistics

Data evaluation

This site's AI-powered navigation is provided by Miao.FlagrightAll external links originate from the internet, and their accuracy and completeness are not guaranteed. Furthermore, AI Miao Navigation does not have actual control over the content of these external links. As of 8:41 PM on December 19, 2025, the content on this webpage was compliant and legal. If any content on the webpage becomes illegal in the future, you can directly contact the website administrator for deletion. AI Miao Navigation assumes no responsibility.

Relevant Navigation

Tencent Docs Smart Assistant

Toast AI HD

QianTu Design Studio AI Assistant

Shownotes

Dream.ai

Powerusers AI

Icons8 Smart Upscaler