What is FinChat? A detailed interpretation of the one-stop robo-advisory platform and a guide to improving investors’ returns

finchat is a new generation of robo-advisory platform based on artificial intelligence (AI) and large language models, featuring chat interaction, supporting investors to quickly query listed company data, reasoning analysis, and personalized stock selection strategies. The platform covers global markets such as US stocks and Hong Kong stocks, and has functions such as intelligent Q, multi-dimensional data mining, condition screening, and industry information push, which greatly improves the efficiency of research and investment decision-making. This article systematically sorts out the core highlights and practical scenarios of finchat, and explains in detail its specific usage and skills in improving investment returns, reducing blind spots, and controlling risk control, so as to help you fully tap the value of AI robo-advisory platforms to empower investment.

Finchat platform explains in detail

FinChat platform overview and basic features

Finchat (official website: finchat.io) is an intelligent financial tool with the help of advanced AI large language models, focusing on the “one-stop data query + reasoning analysis + chat interaction” experience, bringing together real-time market information, financial reports, business interpretation and news information of 750+ listed companies around the world. Both novice and professional investors can ask questions in natural language, dynamically query and compare data.

- Chat-based intelligent interaction: Support natural language, follow-up questions and multiple rounds of in-depth analysis.

- Wide coverage and deep excavation: involving multiple industries such as A-shares in the United States and Hong Kong, technology, medical care, and finance.

- Reasoning and analysis: Have the ability to interpret and logically suggest complex issues such as company growth, industry trends, and financial report changes.

| Functional section | Feature description | Typical applications: |

|---|---|---|

| Financial and business data query | Multi-dimensional data of listed companies is structured | Get a quick overview of company fundamentals |

| Chat-based investment Q | Intelligently understand investors’ natural language inquiries | Verify competitors and in-depth comparison |

| Policy filtering and recommendations | Customize multi-condition filtering such as price-earnings ratio and growth rate | Screen high-quality targets for growth |

| Information tracking and quick overview | Capture company and industry news in real time | Grasp the company’s dynamics and hot news |

| Multidimensional data inference analysis | Investment logic derivation and decision assistance | Industry trends, company risk prediction |

In-depth display and experience entrance

Examples of FinChat Utility Features:

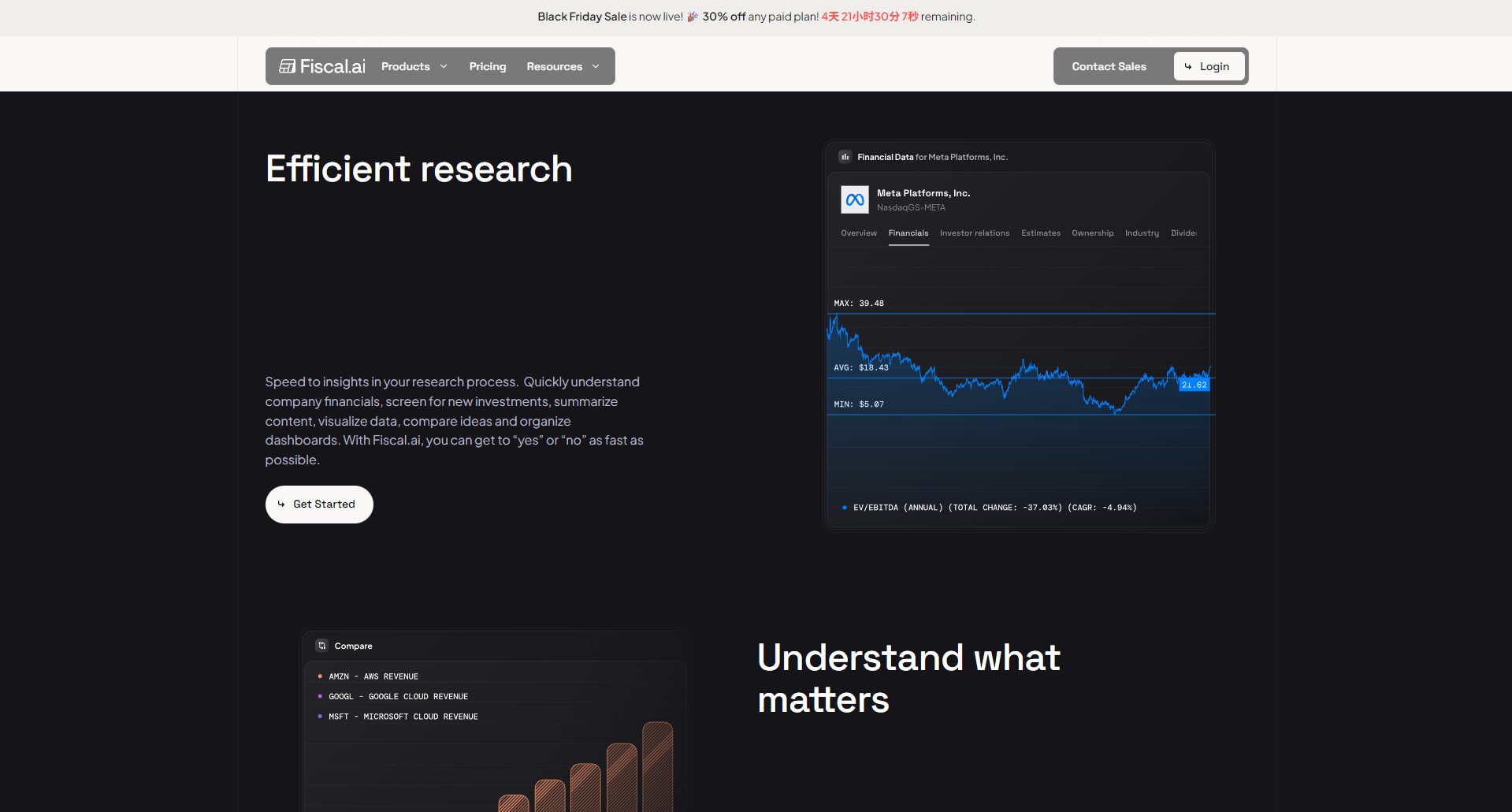

- Panoramic data query of listed companies: Enter the company name/industry to check key data such as financial reports, valuations, and growth rates in seconds. For example, “Inquire about Amazon’s main revenue in 2023”.

- Smart investment strategy screening: Customize the filter to find high-quality stocks with composite conditions, such as “looking for US stock companies with a price-earnings ratio< of 30 and an annual growth rate> of 10%”.

- Interactive Q and analysis: Identify in-depth questions such as “main factors of profit decline” and “competitiveness analysis”, and interpret them with authoritative reports.

- Multi-field auxiliary coverage: Support US stocks and Hong Kong stocks, covering technology, consumption, energy and other industries.

Data AI Technology Advantages

- Data authority: Access to professional databases to ensure timely and accurate information.

- AI Continuous Learning: Continuously enhance understanding and reasoning capabilities for personalized recommendations.

- Extremely easy to use: Simple interface suitable for beginners and institutions.

Practical guide to improving investor returns

How to use FinChat to improve your investment decisions

Investors can use FinChat to achieve:

- Quickly study listed companies and the competitive landscape

Path: Enter the company name or code to automatically obtain financial reports and competitive conditions, and interpret sector drivers and risks.

Improvement point: Greatly reduce the blind spot of research and shorten the optimization cycle. - Intelligent screening and stock selection

Use the conditional filter function to push stock lists in multiple dimensions, which is smarter than traditional tables.

Boost Points: Uncover hidden investment opportunities. - In-depth industry, trend and risk control analysis

Multi-dimensional sorting out industry risks and company changes, and obtaining AI thinking suggestions.

Improvement point: Accurately track trends and identify risks. - Follow the information and real-time wind direction

Automatically push news, industry trends, and policy interpretations.

Improvement point: Grasp breaking news and hot opportunities in a timely manner.

| Operation link | Recommended usage examples | Expected results |

|---|---|---|

| Company profile research | Inquire about the three-year performance of Company A | Quickly screen high-quality targets |

| Intelligent screening of stocks | Choose stocks with fast growth and reasonable valuations | The list is intuitive and easy to use |

| Trend risk analysis | Sort out the risk points of the sector | Reduce the probability of loss |

| Information early warning and tracking | Push the big news of the sector | Grasp hot spots and take profit and stop loss in time |

FinChat has a wide range of applications

The platform is suitable for individuals, analysts, fund managers and institutional research teams, supporting the entire process of work and decision-making, and continuously optimizing depth and efficiency.

Compare with other robo-advisory tools

For example, finchat and mainstream AI investment tools are as follows:

| platform | Core highlights | Scope of application | Price strategy | Featured features | visit |

|---|---|---|---|---|---|

| finchat | Multi-platform data aggregation + intelligent chat | Global markets | Free/Paid | Multiple rounds of Q + conditional screening | Official website |

| StockGPT | AI automatic analysis + real-time monitoring | US Stocks ETFs | gratis | Sentiment analysis | visit |

| AlphaSense | Intelligent financial search + in-depth analysis | institution | Enterprise level payment | Report aggregation | visit |

| Finalle | Real-time signals + charts | Investor/trader | Pay | Market sentiment | visit |

| ChainGPT | Cryptocurrency analysis | Digital currency circle | Pay | Contract/NFT analysis | visit |

FinChat stands out for its low threshold for use, rich data, and efficient interaction, making it more suitable for individuals or teams with in-depth investment analysis.

Practical tips for investors to use FinChat efficiently

- Make full use of natural language communication and questioning

Ask more in-depth complex questions such as “changes in profit dynamics” and “peer comparison”, and AI can intelligently interpret them. - Multi-condition compound screening control threshold

For example: “Technology companies with a price-earnings ratio of ≤15, ROE ≥ 12%, and market capitalization growth in 2023”. - Pay attention to market dynamics and changes

Use the information push function to warn short-term opportunities in real time. - Risk control and tracking optimize portfolios

Flexible adjustment combined with AI and personal judgment to reduce the risk of drawdown.

In the era of deep integration of AI and finance, finchat has become the “new Swiss Army knife” for investors with multi-dimensional data, intelligent reasoning and efficient interaction. By leveraging its multiple capabilities and personalized strategies, both novices and professionals can efficiently seize market opportunities and achieve continuous profit improvement. In the future, data-driven + AI intelligence will become the core of new financial competition.

© 版權聲明

文章版权归作者所有,未经允许请勿转载。

相關文章

暫無評論...